Term Insurance vs. Whole Life Insurance: Which One is Better?

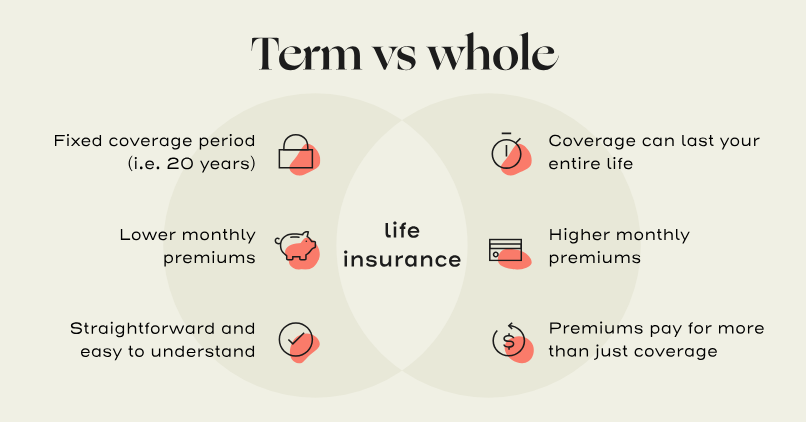

When it comes to protecting your family’s financial future, insurance is a non-negotiable part of the plan. But once you begin exploring options, you’ll often come across two popular categories: term insurance and whole life insurance. Both offer life cover, but they function very differently. The big question is, which one is better for you?

In this article, we’ll break down what these policies mean, how they work, their benefits, and the key differences that will help you decide.

What Is Term Insurance?

A term insurance plan is a pure protection policy. It provides life cover for a fixed period, usually 10, 20, 30 years or more. If the policyholder passes away during this term, the nominee receives the death benefit. If the policyholder survives the term, there is no payout (unless the plan includes return-of-premium options).

Key features of term policies include:

- Large cover at an affordable premium.

- Flexibility in choosing policy duration.

- Option to enhance coverage with riders like critical illness or accidental death benefit.

- No maturity benefit (unless opted through riders or add-ons).

What Is Whole Life Insurance?

As the name suggests, whole life insurance provides coverage for the policyholder’s entire lifetime, typically up to 99 or 100 years of age. Unlike term insurance, it not only offers a death benefit but may also have a savings or cash value component depending on the plan chosen.

Key features of life insurance plans in the whole life category include:

- Lifetime coverage.

- Higher premiums compared to term insurance.

- Potential for cash value accumulation in certain types of policies.

- Acts as both protection and a long-term financial planning tool.

Key Differences Between Term Insurance and Whole Life Insurance

| Feature | Term Insurance | Whole Life Insurance |

| Coverage Duration | Fixed term (10–40 years) | Lifetime (up to 99/100 years) |

| Premiums | Very affordable | Higher due to lifelong cover and savings component |

| Payout | Death benefit only (unless ROP option chosen) | Death benefit + cash value in some plans |

| Purpose | Pure protection for income replacement | Protection + wealth transfer/legacy planning |

| Best Suited For | Young earners, families needing high cover at low cost | Individuals seeking lifelong cover and estate planning |

Advantages of Term Insurance

- Affordability: Provides high coverage at a fraction of the cost of whole life insurance.

- Simplicity: Easy to understand with no complex investment components.

- Customizable: Add riders for enhanced protection.

- Ideal for Income Replacement: Ensures your family’s lifestyle continues if you are no longer around.

If you’re exploring options, you can look at different term policies to understand how they fit into your financial plan.

Advantages of Whole Life Insurance

- Lifelong Protection: Covers you throughout your lifetime, ensuring your family is always protected.

- Cash Value Accumulation: Some plans build cash value that can be borrowed against or withdrawn.

- Estate Planning Tool: Helps in wealth transfer and creating a legacy for heirs.

- Stability: Premiums remain fixed in most whole life plans.

Those looking for a combination of insurance and legacy creation can explore different life insurance plans that fall under the whole life category.

Which One Should You Choose?

The choice depends on your financial goals, responsibilities, and stage of life.

- Choose Term Insurance If:

- You are young and need large coverage at an affordable premium.

- You want to secure your family’s future against liabilities like home loans or children’s education.

- You prefer simplicity without investment components.

- You are young and need large coverage at an affordable premium.

- Choose Whole Life Insurance If:

- You want lifetime coverage for peace of mind.

- You are looking at wealth transfer and estate planning.

- You want a mix of insurance and savings in one product.

- You want lifetime coverage for peace of mind.

Combining Term and Whole Life Insurance

It doesn’t always have to be one or the other. Many people choose a combination, buying term insurance for high coverage during working years and later adding whole life insurance for legacy planning. This hybrid approach provides both affordability and lifelong protection.

Common Mistakes to Avoid

- Choosing Without Assessing Needs: Don’t buy a policy just because it’s popular. Assess your goals first.

- Ignoring Premium Affordability: Whole life premiums can be expensive, ensure they fit into your budget.

- Overlooking Riders: Riders can enhance protection and should not be ignored.

- Not Reviewing Policies: As life changes, review your coverage to make sure it aligns with your current needs.

Final Thoughts

Both term and whole life insurance have their merits. Term plans offer cost-effective protection during critical earning years, while whole life plans provide lifelong coverage and potential wealth transfer. The right choice depends on your priorities, affordability and pure protection versus lifelong cover and legacy planning.

If you are beginning your journey, start by comparing term insurance for affordable protection. For those looking at a lifetime of security and legacy creation, review life insurance plans that provide whole life coverage.

By making an informed choice today, you can secure not just your family’s present but also their long-term future.